Polinat & TCL

The necessity for lower utilization rates at panel producers, be it LCD or OLED, is a function of the classic imbalance between capacity and demand, and while there are many ways in which demand can be influenced, supply/capacity, especially in the display space, where greenfield capacity has a high capital cost and process equipment has long lead times, needs years to plan and complete, which means panel producers must anticipate industry and macro conditions years in advance. Such advanced planning is fraught with influences that color panel producer views and complicate the process further and such can push a short-term or long-term roadmap toward a postponement or eventual cancellation, or worse, an idle or under used facility.

The threat of competition is certainly one ‘influencer’ in the capacity decision making process, but there is competition in every business. In the case of the display business however there is another kind of competition that we believe is, and has been, a major factor in exaggerating the cyclical nature of the panel business, and that is political nationalism (aka ‘polinat’ – you heard it here first ☺). Under our definition, polinat is the influence of politics in a country’s desire to be recognized globally, which puts the government’s necessity to gain global acceptance above that of the populous and can be a significant influence on a country’s economic and business outlook, depending on the political system. Over the last 12+ years the Chinese government has had a significant influence on the display space through government sponsored funding of display capacity, which was readily accepted by panel producers.

The plentiful funding, which typically comes from provincial or city owned entities, has allowed Chinese panel producers to expand capacity at an unprecedented rate, which in many cases had little to do with supply/demand and more to do with a desire to cement China’s place in an industry that has previously been dominated by other Asian competitors. Underlying this political nationalism has been good old company rivalry between Chinese panel producers themselves, which has served to aggravate the situation. The Chinese display industry has been focused on chasing market share since its inception and now is the dominant force in the LCD display space, and has built out very significant capacity under the assumption that the LCD display business will continue to grow, with China the dominant force behind that growth.

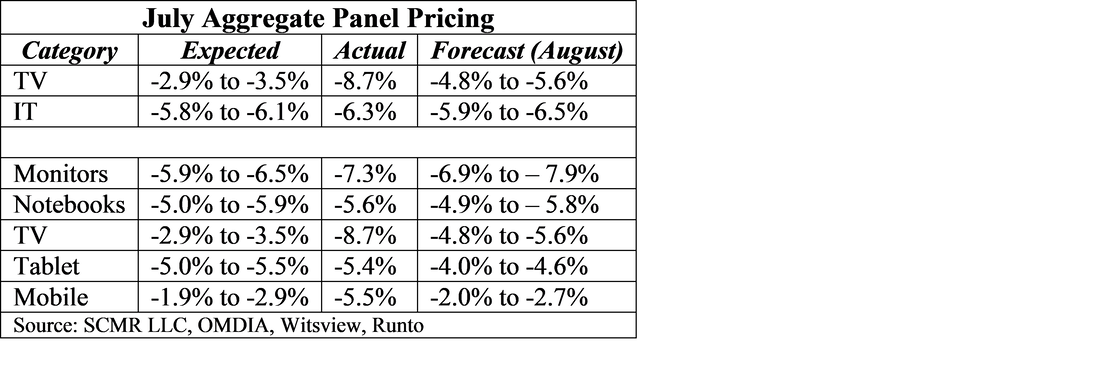

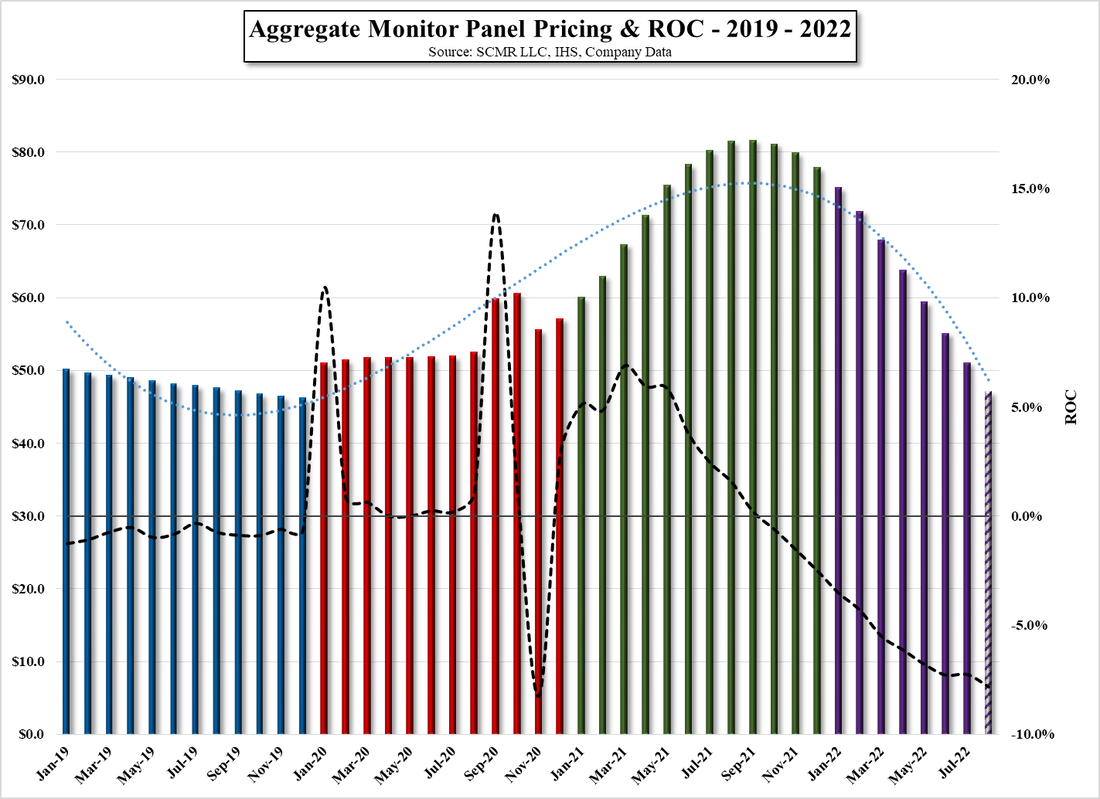

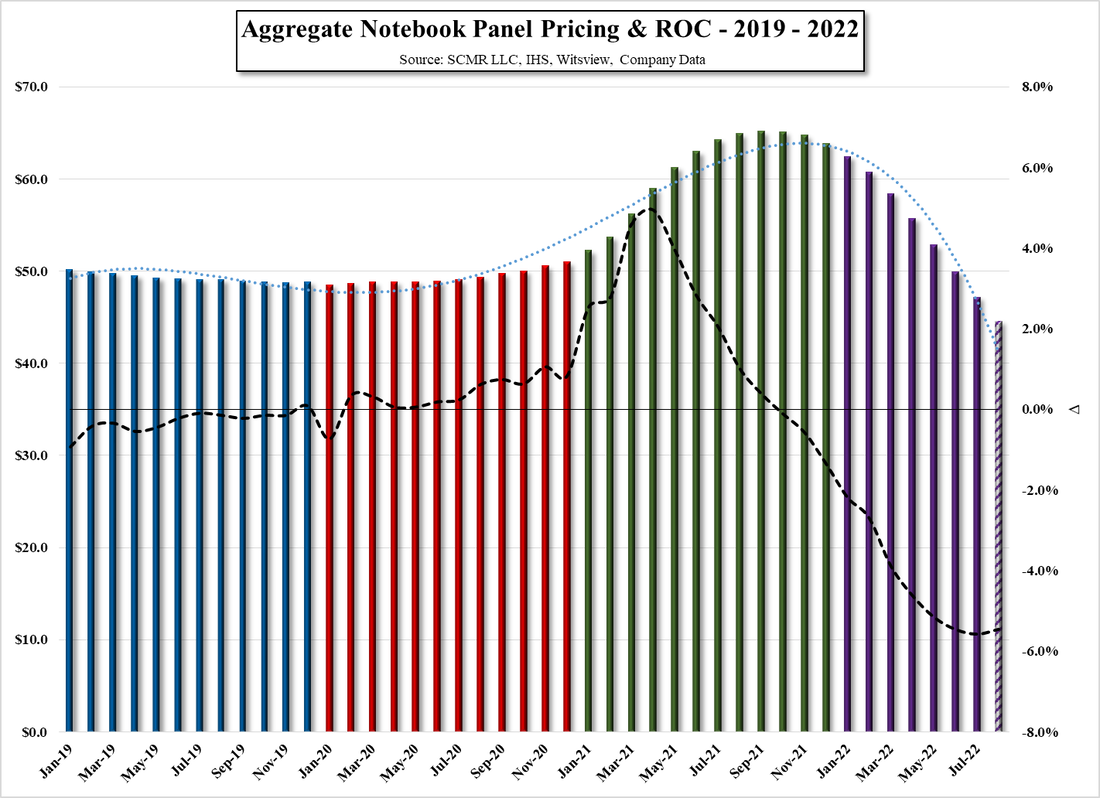

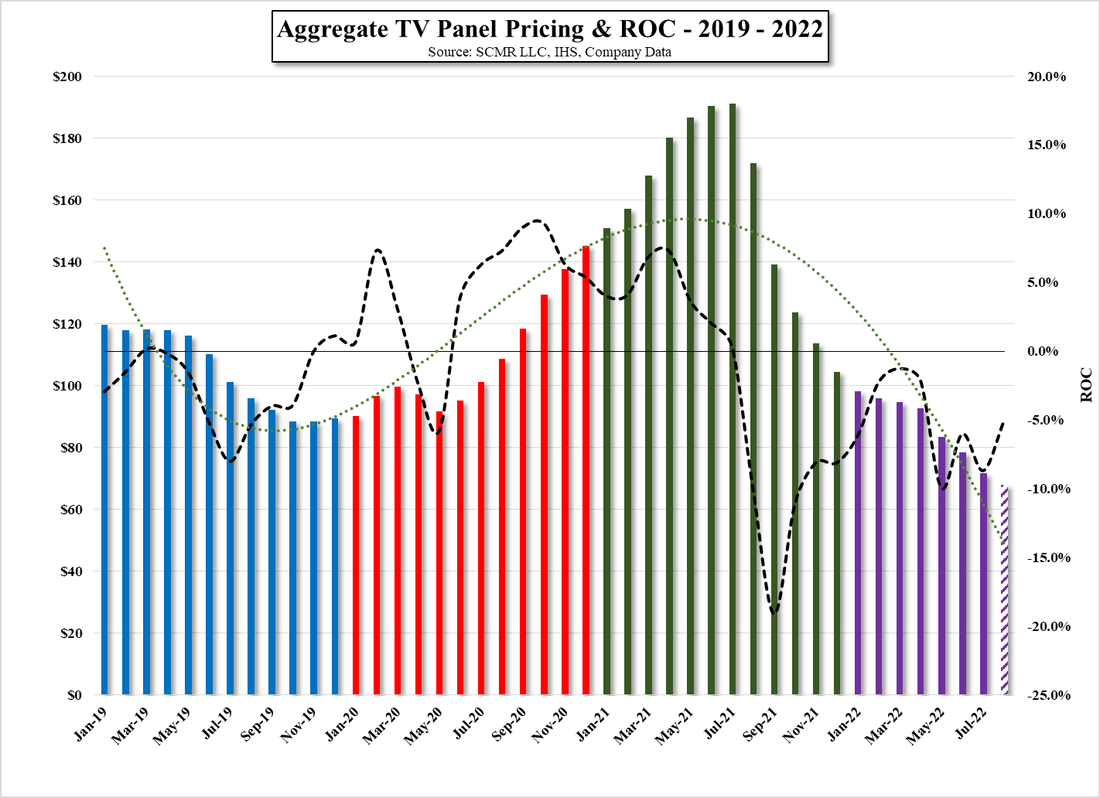

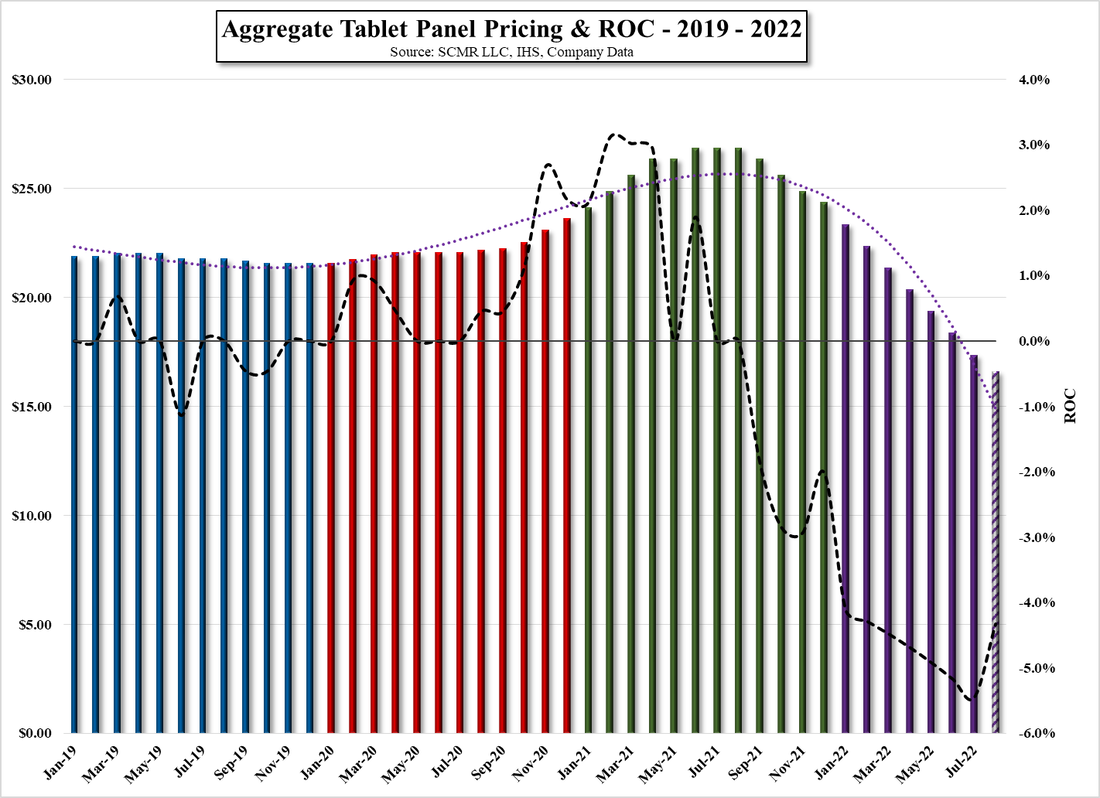

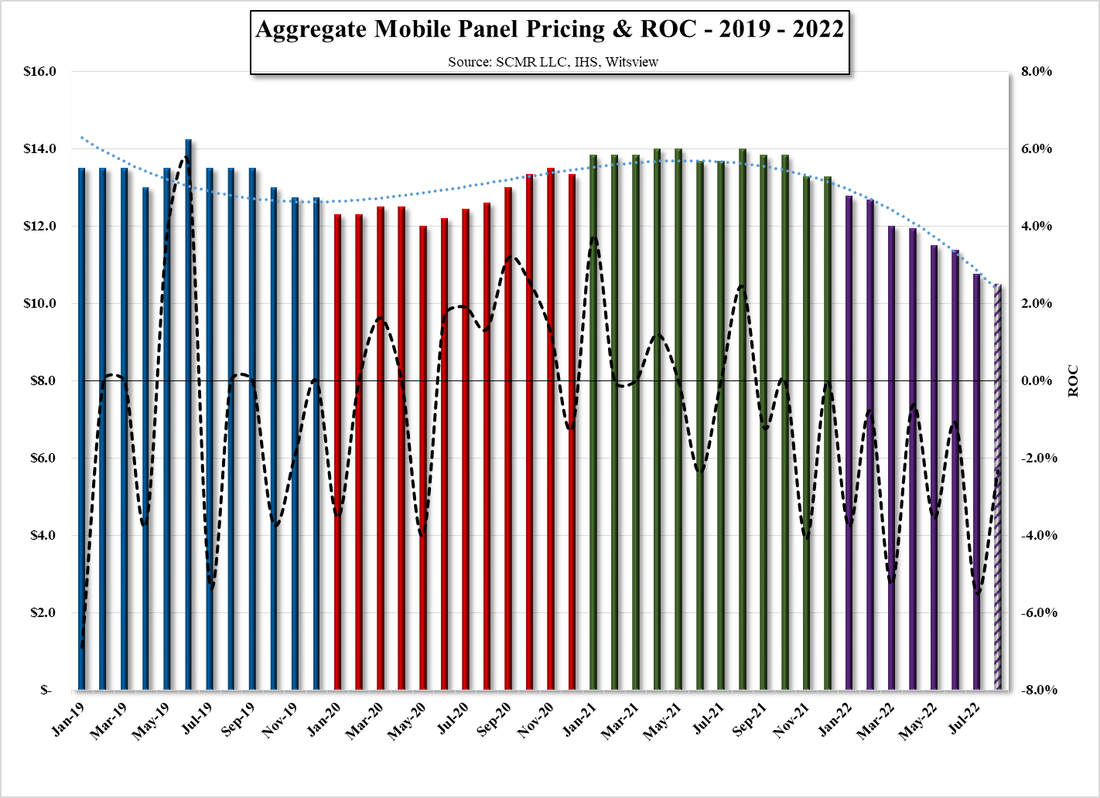

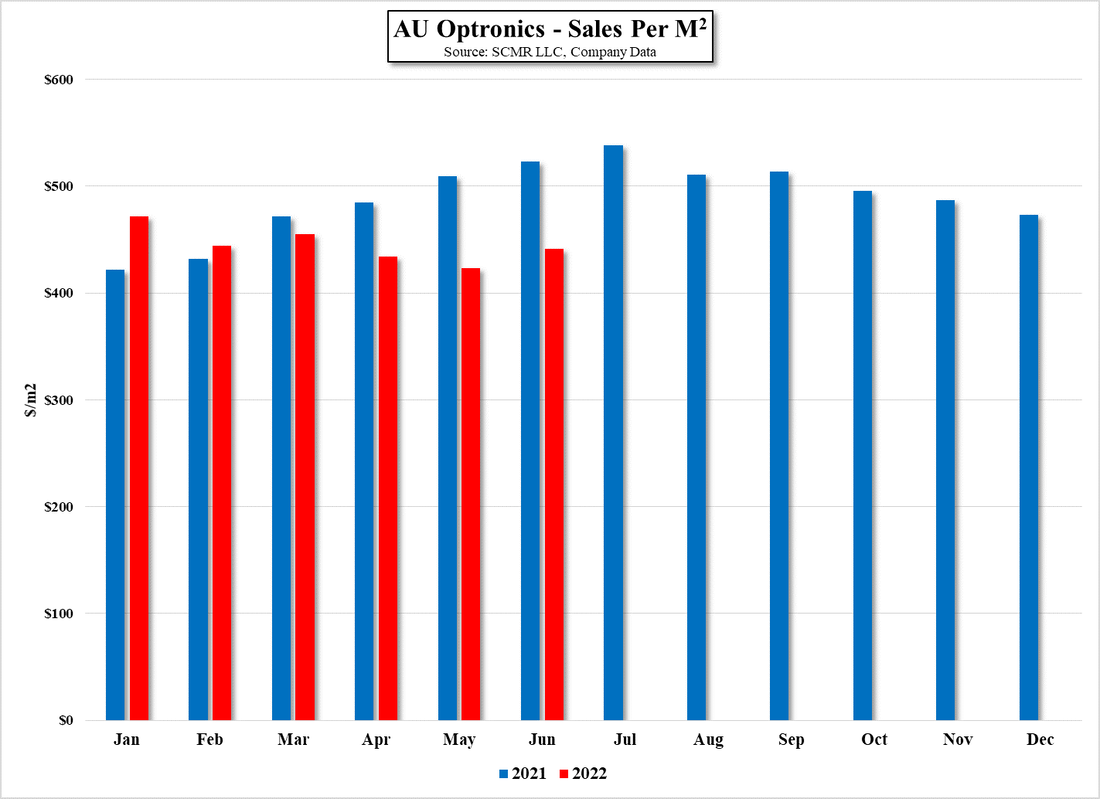

This enthusiastic capacity expansion was reinforced during the COVID-19 pandemic, as panel prices rose under unusual demand circumstances and most panel producers became profitable. This positive justification led to further expansion planning under the assumption that we were living in a ‘new’ demand environment and funding continued, even after panel prices began to deteriorate in July of last year, and while TV panels pricing declined rapidly, panel producers continued to justify those expansion plans citing the mantra that IT panel pricing (monitors, notebooks, and tablets) remained strong. Unfortunately that IT panel price stability was not sustainable given the fact that most panel producers shifted capacity from TV panel production to IT panel production as TV panel prices deteriorated, which caused IT panel prices to deteriorate, especially as demand weakened.

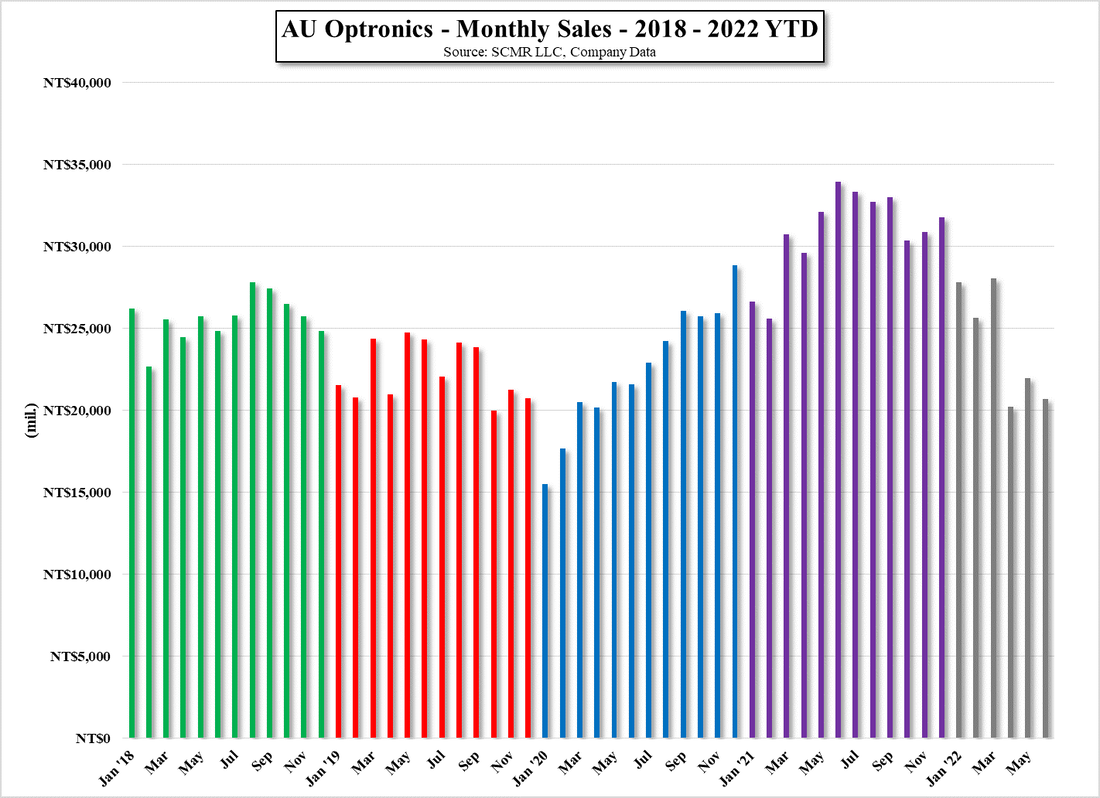

Little has been said during the 1st half of this year about previously announced expansion plans, but we expect much has been said internally and most recently a trip by the chairman of TCL (000100.CH) the owner of China’s 2nd largest panel producer Chinastar (pvt), visited South Korea to meet with Korean equipment suppliers to discuss ‘the current state of the industry’. According to the South Korean trade press, those discussion were focused around the TCL chairman explaining to equipment suppliers that delayed payments and timeline pushbacks were the result of the overall weakness in the display market and to discuss the feasibility of changing the format of some of the equipment from small panel OLED (Gen 6) to Gen 8 in order to move more toward the production of IT OLED panels and away from those for smartphones.

Equipment producers were told that Chinastar’s T5 Gen 6 LCD fab in Wuhan that TCL announced late last year would be expanded, has delayed the expansion until 2023 and the company’s T9 Gen 8.6 LCD fab project in Guangzhou will also be postponed for 6 months, apologizing for the delay in progress payments. This is a sensitive subject for South Korean equipment suppliers as we mentioned in notes on 12/29/20 and 6/1/21, as a company known as Jiangxi Infintech Optoelectronics (defunct) has ordered roughly $77m from a number of South Korean suppliers for a $3.5b mixed use LCD/OLED Gen 6 fab it was planning to build in 2018. After multiple delivery pushouts and little, if any payments, the company’s management abandon the project and left the country leaving South Korean equipment vendors with raw materials and project expenses that were never paid and the expensive task of trying to recover funds through the Chinese courts.

TCL is lucky in that Samsung Display (pvt) has a 12.3% share in TCL, which it purchased when it sold its LCD fab in Suzhou to Chinastar in August 2020. This gives TCL considerable credibility with Korean suppliers, but more importantly the delays in TCL’s display expansion projects are indicative of the theory that the idea that helter-skelter expansion might not be the only way to prove a country’s ability to compete in the world market, and that the concept of ‘If you build it they will come’ was a line form a movie and not necessarily a motivation for spending billions of dollars. The continued expansion of LCD production capacity through 2023 and 2024 against a more moderate demand cycle was one that give us little hope for more than modest sales gains for the industry and as that philosophy spread to the OLED space, the same fate, out a few years further, was also inevitable, but a more rational view of capacity now seems to be starting to take hold with the TCL chairman’s trip a good omen.

That said, we still have to account for the political nationalism that exists in China which is exacerbated by anti-China political rhetoric in the US. Historically capacity delays tend to disappear at the first sign of rising prices and while Samsung Display made the hard decision to exit the large panel display business years ago and LG Display (LPL) has been following a similar path, that decision seemed a very wise decision in 4Q 2019 and a terrible one in July 2021. The underlying price competition from Chinese LCD producers that caused such decisions, a function of the Chinese desire to prove its global worth by dominating a space that had been controlled by it political and regional rivals, still exists and our concern is that while we take the TCL/Chinastar postponements as anecdotal evidence that there is potential for more rational display capacity expansion planning in China, changing a mindset is a difficult task that either takes a long time or is forced economically. While we prefer the former and abhor the idea of an extended downturn in the display and CE space, sometimes it takes being hit over the head to figure out that you are the one doing the hitting.

RSS Feed

RSS Feed